By Cynthia ChungEuropeans are presently being told that the energy crisis they are entering, with natural gas prices now four times higher than last year, stems from a longer winter, competition with East Asian countries for gas, and problems on the supply end with delayed maintenance and less investment. These gas prices are in turn determining the price in electricity markets, since 1/5 of Europe’s electricity comes from natural gas. How do we stabilize this crisis and avoid it in the future? We are told the answer is to accelerate the transition from fossil fuels to renewables and biofuels (often nuclear energy is not even mentioned as a zero carbon energy source). We are told that it is the overreliance on natural gas and coal by Europeans and their slow transition to renewables and biofuels that is at the heart of this energy crisis. This sentiment was given credence by the EU Commission in Brussels. EU Climate Czar Frans Timmermans declared in his opening remarks at the “Fit for 55” discussion on October 6, 2021:

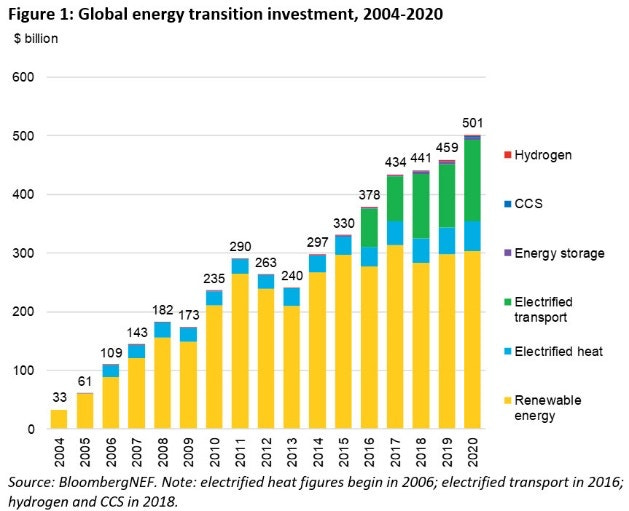

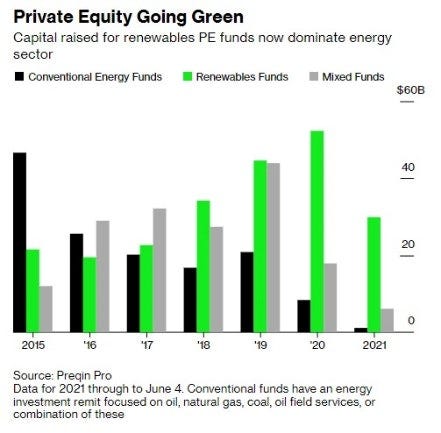

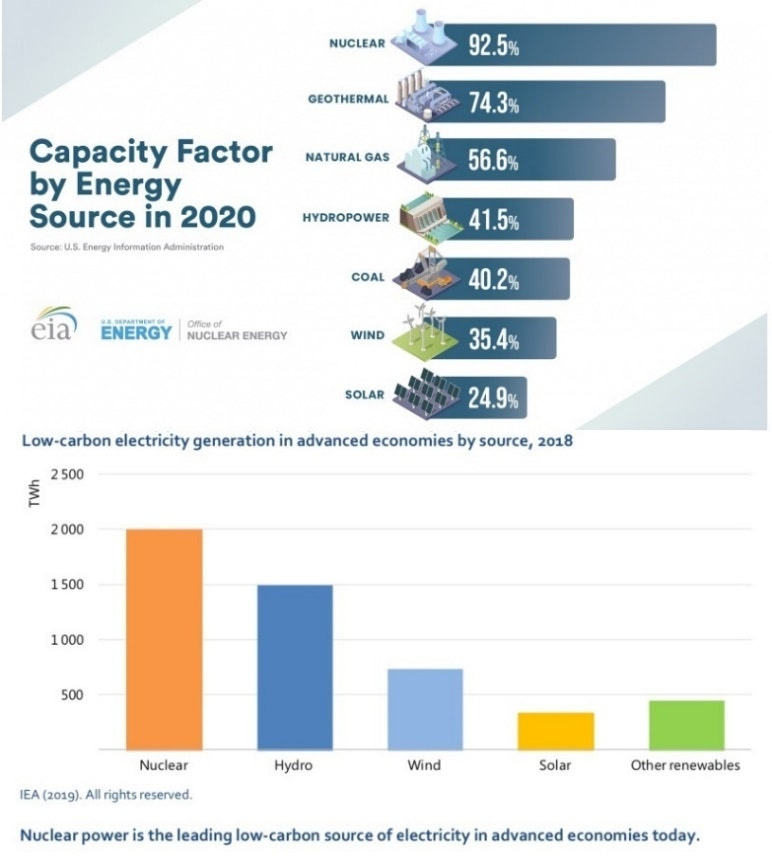

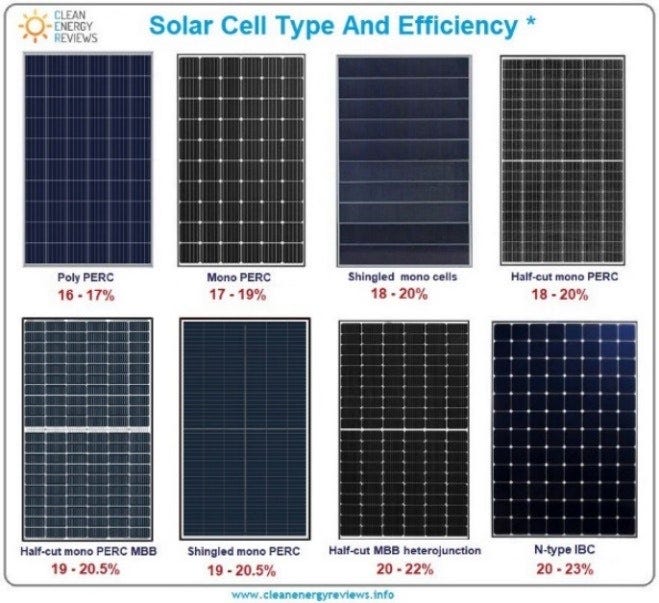

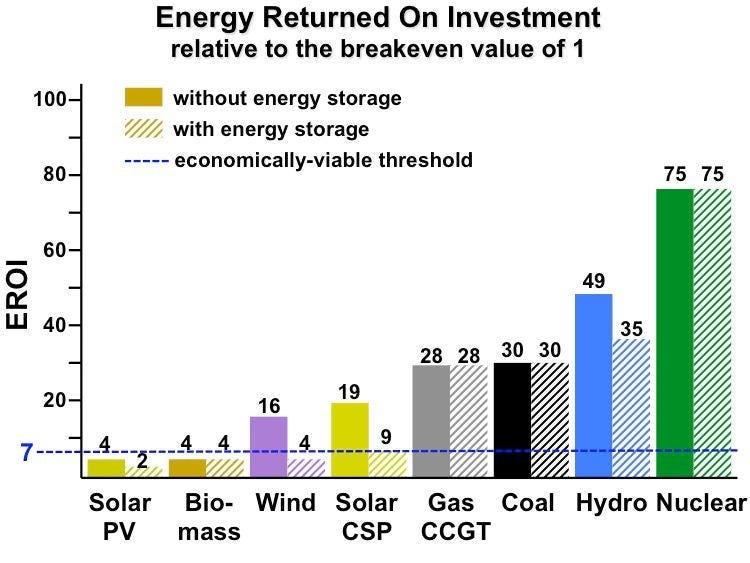

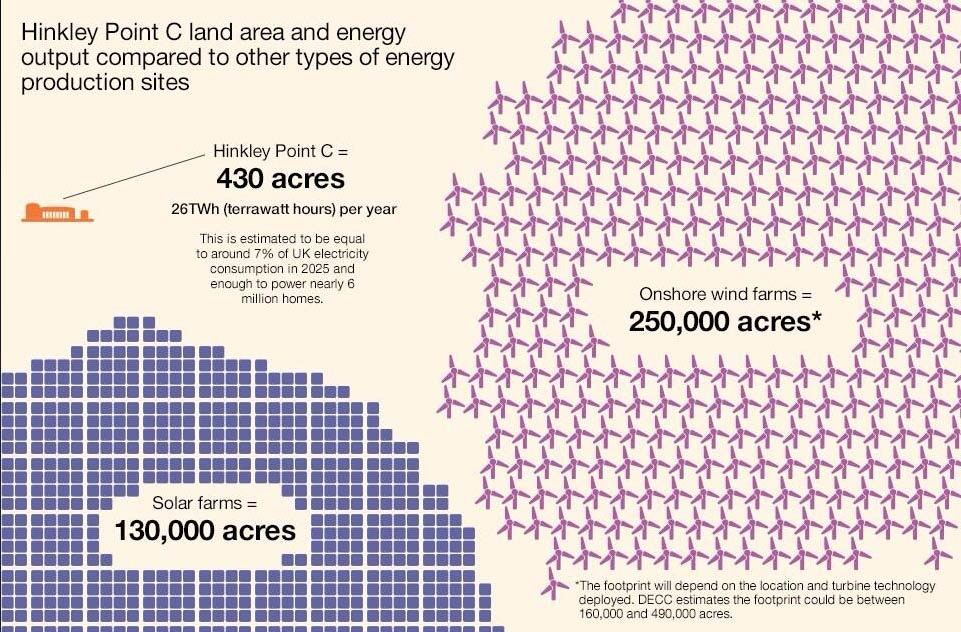

Thus, the EU has taken matters into its own hands and proposed “Fit for 55” in July 2021, a plan to reduce greenhouse gas emission by 55% by 2030. Under an accelerated legislative process, the plans may become law in 2022. However, is Mr. Timmermans’ statement accurate? And, why is non-renewable energy being taken down faster than renewable energy is going up? All amidst an energy crisis and a decrease in food production due to a shortage in fertilizer (which requires energy). According to this Bloomberg article from January 2021, the world invested unprecedented amounts in low-carbon assets in the year 2020, a record $501.1 billion, beating the previous year by 9% despite this overlapping with the COVID-19 pandemic. Head analyst of BloombergNEF (BNEF) reported: “Our figures show that the world has reached half a trillion dollars a year in its investment to decarbonize the energy system. Clean power generation and electric transport are seeing heavy inflows, but need to see further increases in spending as costs fall… We need to be talking about trillions per year if we are to meet climate goals.” According to this other Bloomberg article, private equity has been in the process of ditching fossil fuels since 2017. That is, serious investment into transitioning towards green energy started 5 years ago, the magic number Timmermans referenced to as if it wasn’t actually happening. What both graphs demonstrate is that there has been bountiful funding into zero carbon energy (except for nuclear), in fact, trillions. But apparently, this is not enough before we start to see an actual payout in energy supplies. Why? Mark Carney, former governor of the Bank of Canada, former director of the Bank of England, and now the UN Special Envoy for Climate Action and Finance, announced at COP26 that an “estimated $100 trillion of investment [would] be needed over the next three decades for a clean energy future.” That is an incredible amount of money. There are several issues with this statement. Why does this clean energy market require such an exorbitant amount of financing? For countries that cannot afford these costs, what are they expected to do? Why are we being told that it will not be until three decades from now that we will see the energy market stabilised? And why are non-renewable energy supplies being rapidly taken down, such that nuclear will be non-existent in countries like Germany in one year’s time, if the timeline to be fully operational using green energy is 30 years from now? Where is the energy going to come from in the meantime, during this so-called transition phase? Let us start with the exorbitant cost. A major factor to this is because renewable energies such as wind and solar, have a lower capacity factor than non-renewables, most notably than that of nuclear. Capacity factor measures the actual generation of energy compared to the maximum amount it could potentially generate in a given period without any interruption. Therefore, when you hear things like x number of solar plants or wind turbines can generate the same amount of energy as one nuclear plant, be wary, since they are using the maximum potential energy output (i.e. sunny all 24hrs of a day with no clouds, high winds 24/7) rather than factoring in the capacity factor. What a nuclear plant promises, it delivers. This is not the case with wind and solar, the effects of which we are seeing in Europe presently. (For those who are afraid of nuclear because of Fukushima refer here.) Note, in the above image solar panels are shown to have a maximum capacity factor of 24.9% but that is really quite generous. Depending on the solar panel you are using, the capacity factor typically ranges from 17% to 23%. Wind also has a capacity factor that often is lower than the generous 35.4% shown above. In the case of Ontario, Canada wind energy’s capacity factor averages 27%. What this means, is that if your country requires x GW of energy to sustain itself, and if you are using solar or wind at a capacity factor of 25%, then you would need to build 4x the number of solar or wind plants than what you would theoretically need in order to receive 100% of that promised energy output (i.e. the potential maximum energy output they use to promote their products as competitors to non-renewables). Thus, when claims are made that solar panels are the cheapest form of energy, they are not accounting for the capacity factor, and at best the cost is actually 4x and at worst 6x what they are actually claiming on paper. Both solar and wind also have the extra cost of battery storage and a fully functioning energy grid for periods where there is no solar and wind activity. Energy Returned on Investment, or EROI, is the ratio of energy returned to energy invested in that energy source, along its entire life-cycle. When the number is large, energy from that source is easy to get and cheap. However, when the number is small, the energy from that source is difficult to get and expensive. The break-even number for fueling modern society is about 7. Note here that according to EROI, solar PV and biomass do not even make the cut, you are putting more energy in than you are receiving back. As we have seen so far, nuclear is the most efficient and cost effective zero-carbon energy source. Germany boasts of 45% gross renewable energy but this is not telling the full story. In a 2021 study, The Frauenhofer Institute estimated Germany must install at least 6-8x present solar capacity in order to reach 100% carbon free goals by 2045, with estimated costs reaching into the trillions. The report says that the present gross 54 GW solar capacity must increase to 544 GW by 2045. That would mean a land space of 3,568,000 acres (1.4 million hectares), which is more than 16,000 square kilometers of solid solar panels across the country. This is not even including all the wind stations. Farmland and forests will be destroyed and paved, all for so-called environmentally friendly though unreliable and incredibly expensive solar and wind renewables. In the midst of major food shortages, due to the energy crisis which has reduced fertiliser production, Europeans are also being told that they need to severely cut down on farmland to make way for the new farms of solar panels and windmills. In addition, solar panels present a very serious toxic waste situation with no readily available solutions, unlike the case of nuclear. The International Renewable Energy Agency (IRENA)’s official projections assert that “large amounts of annual waste are anticipated by the early 2030s” and could total 78 million tonnes by the year 2050. Harvard Business Review reported:

The Harvard Business Review adds that the solar industry does not actually have a plan to deal with the massive amount of toxic waste that nations will have to deal with 10 years from now, adding that although the financial incentive for funding the production of solar panels is high, there is little “financial incentive” in figuring out what to do with the waste. Harvard Business Review writes:

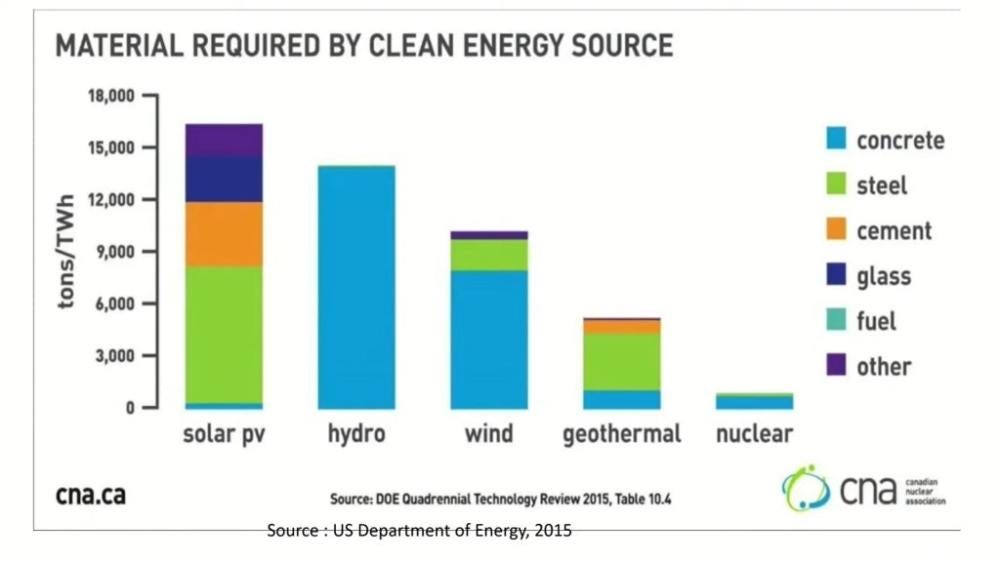

Thus, again there are massive hidden costs in solar panels that presently do not account for the cost of managing its own waste at astronomical prices. But the fallbacks do not end there. Europe and North America will require huge volumes of steel and concrete to build the expected millions of solar panels and wind farms. How are the materials steel and concrete produced? By coal and nuclear energy. Steel and concrete production is so energy intensive that solar and wind energy are not actually sufficient to produce their own parts. Not only this, but these unreliable renewables are consuming a massive quantity of energy for their mass production, amidst an energy crisis that does not show any end in sight. Food production has already drastically decreased due to the shortage of fertilizer (that requires energy for its production). Is food production expected to continue to plummet so that we can build these massive unreliable solar and wind farms with increasingly no significant alternative energy source, other than hydro, to fall back on? The fact is that Germany already started its transition to zero-carbon energy in 2011 when former Chancellor of Germany, Angela Merkel announced the Energiewende, which made the claim that Germany could attain 100% renewable electricity generation by 2050. However, there was never an intention that Germany would ever be self-sufficient in its energy production. The study by Martin Faulstich and the State Advisory Council on the Environment (SRU) argued that Energiewende would work because Germany could contract to buy surplus, carbon-free, hydro-electric power from Norway and Sweden. However, hydropower reserves of Sweden and Norway (after a dry and hot summer) are dangerously low coming into this winter and are operating at only 52% capacity. That means that the level of electricity exported to Denmark, Germany and most recently the UK are likely going to plummet. In addition, Sweden is contemplating shutting its own nuclear plants which provide 40% of Swedish electricity. If Sweden decides to shut down its nuclear, it will no longer be able to supply the energy needs of these other European countries. What then? Despite all these uncertainties shaping Europe’s energy crisis, on December 31, 2021 the new German coalition government shut down 3/6 of their nuclear power plants permanently. Incredibly, they have decided to do this amidst a devastating energy crisis, such that a severe cold front could lead to power blackouts. Because of the German government’s hesitancy to use Nord Stream 2, Germany is now facing a 500% increase in the spot price of electricity compared with January 2021. The remaining 3 nuclear plants are scheduled to close by the end 2022. Germany has also been cutting down on its coal generation. Since 2016 it has closed 15.8 GW of coal generation. To make up for the inadequacy of solar and wind energy output, Germany’s electric grid must import a massive amount of electricity from France and the Czech Republic, ironically much of it from their nuclear plants. Germany today has the highest electricity cost of any industrial nation as a result of the Energiewende. Contrary to what Mr. Timmermans is claiming of what the situation would be if countries made the transition to green energy 5 years ago, Germany started its green transition 11 years ago and the verdict is plain for everyone to see. They are the least sovereign in their energy self-sufficiency and they are paying the highest prices for their basic energy usage. On February 22, Chancellor of Germany Olaf Scholz announced the freezing of Nord Stream 2 as a “punishment” to Putin’s recognition of the independence of the regions of Donetsk and Luhansk in formerly eastern Ukraine on February 21. But who is Chancellor Scholz really punishing here? Bizarrely, when Germany’s Federal Minister for Economic Affairs and Energy Peter Altmaier made an investment deal with China in January 2021 around green hydrogen energy, there was criticism from the United States as to why Altmaier did not wait for Biden’s inauguration before signing such a deal! Apparently, Germany does not have the right to decide any of its energy policies, even if they are green. At COP26, UN Special Envoy for Climate Action and Finance Mark Carney announced that more than 450 firms representing $130 trillion USD in assets (40% of the world’s financial assets) now belong to the Glasgow Financial Alliance for Net Zero (GFANZ). Carney also announced that Michael Bloomberg would be the UN Special Envoy on Climate Ambition and Solutions and Race to Zero Ambassador. It is in fact Carney’s approach to financing green energy that is the greatest factor in causing the price increase in non-renewable forms of energy. Mark Carney, former director of the Bank of England, has called for a “net zero banking alliance” in which banks have agreed not to lend to producers but only to put funds into the green bubble, the carbon bubble and so on. As a result, future energy production will drop even though there are ample resources available, creating further artificial scarcity. In an interview with the Washington Post, Mark Carney stated that private banks in the financial sector must produce a change in the plumbing of the financial system in order to push liquidity into the speculative bubble while cutting investments to the productive economy. Carney said climate change must become the “fundamental driver of every investment decision or lending decision.” In other words, either you go along with the green program (that ignores nuclear as green) or you don’t get credit. Which is a policy that will, and is, quite predictably driving up energy prices. This policy of Mark Carney has already caused the bankruptcy of several energy companies across Europe, and there has been no correction to this policy despite Europe being in an energy crisis. Blackrock and other global money trusts have forced energy investment away from oil, gas and coal to buildup solar and wind. They call it ESG (Environmental, Social, Governance) investing. ESG investing works by setting up ESG certifying companies that award ESG ratings on stock companies and financially punish those who do not comply with the ESG demands. The rush into ESG investing has made billions for Wall Street and the City of London. It has also put a damper on future development of oil, coal and natural gas for most of the world. It is evident that this is not a full energy transition to solar and wind power. Rather, we are seeing a rapid gutting of all non-renewable energies before there is an ability to provide the promised energy payout we are told we will see with solar and wind, which ironically need coal and nuclear energy for their production. At the rate that they are closing all other competing energy sources, it does not look like even the production demands for wind and solar farms can be met, there will simply be not enough energy to do anything. The Rising Tide Foundation is a non-profit organization based in Montreal, Canada, focused on facilitating greater bridges between east and west while also providing a service that includes geopolitical analysis, research in the arts, philosophy, sciences and history. Consider supporting our work by subscribing to our substack page and Telegram channel at t.me/RisingTideFoundation. This article was published on The Rising Tide Foundation.

|

Saturday, May 18, 2024

The ABCs in Energy: Do We Actually Understand How Energy Works?

Subscribe to:

Post Comments (Atom)

Plato's Fight Against Apollo's Temple of Delphi and the Cult of Democracy

Watch now (108 mins) | We are too often drawn into the bad habit of thinking of ancient Greek thinkers like Plato and his teacher Socrates a...

-

Greetings everyone ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Rising Tide Foundation cross-posted a post from Matt Ehret's Insights Rising Tide Foundation Sep 25 · Rising Tide Foundation Come see M...

-

March 16 at 2pm Eastern Time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment